My repository of thoughts on interesting ideas.

The Fate of Microsoft’s Acquisition of Activision Blizzard

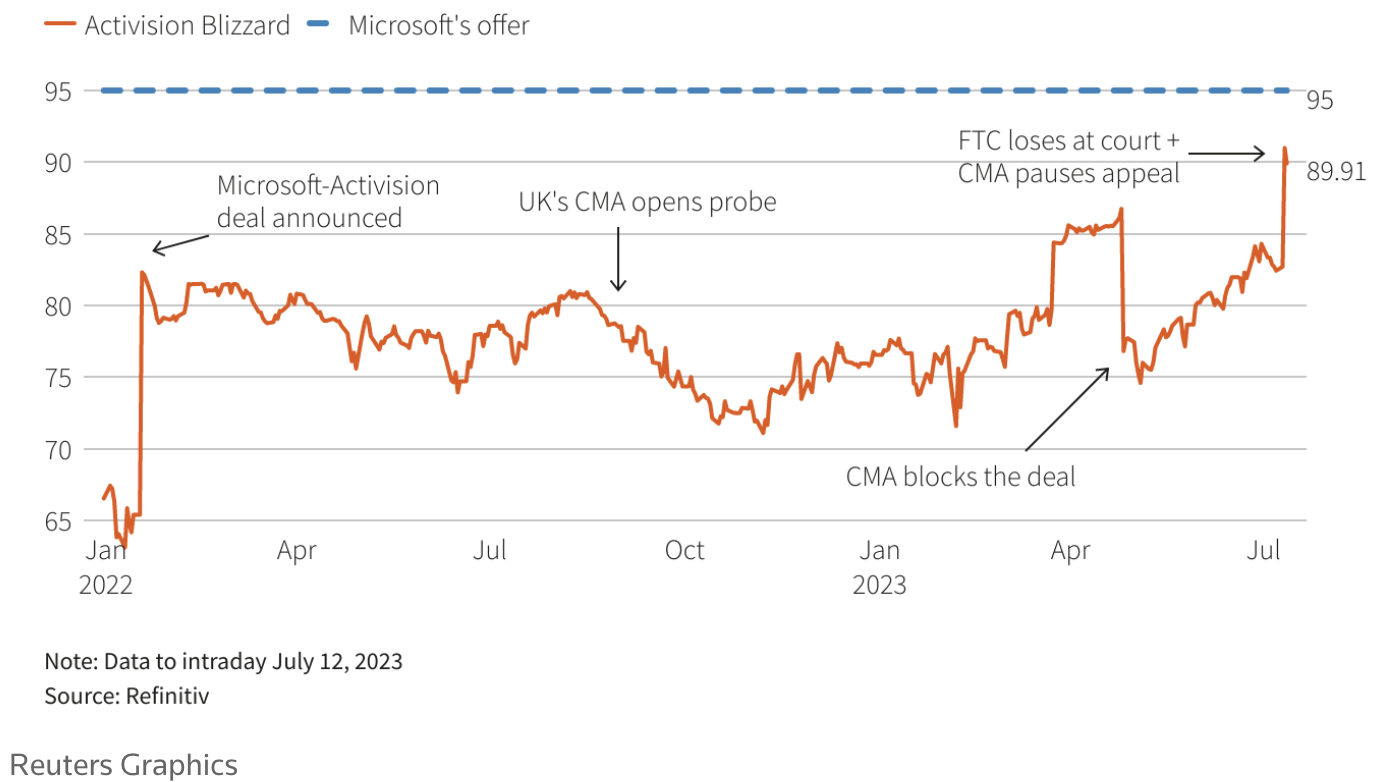

Yesterday, the FTC filed a notice to the Ninth Circuit Court of Appeals to appeal a court decision to enable Microsoft to continue with its acquisition of Activision Blizzard, the company behind popular video game franchises “Call of Duty”, “Diablo”, and “World of Warcraft” among others. This regulatory hurdle increases the likelihood that a deal will not be reached before the July 18 deadline, at which point Microsoft will either have to ask for an extension or pay $3 bn to essentially walk away.

Previous Ruling

This has come after Judge Jacqueline Scott Corley’s Tuesday decision to deny the regulator a preliminary injunction request. In the ruling, Judge Corley stated, “For the reasons explained, the Court finds the FTC has not shown a likelihood it will prevail on its claim this particular vertical merger in this specific industry may substantially lessen competition. To the contrary, the record evidence points to more consumer access to Call of Duty and other Activision content.” Microsoft’s several licensing deals and offers to bring Activision Blizzard franchises, including “Call of Duty” or “CoD”, to cloud and subscription gaming providers, Sony, Nintendo, Nvidia, and others profoundly impacted this conclusion of this week’s earlier hearing.

FTC Merger Enforcement

The FTC’s attack on this particular merger is not unique. In the past few years, it has initiated battles to combat mergers between Amazon and MGM, Meta and Within, and now Microsoft and Activision Blizzard. These cases represent Chair Lina Khan’s goal to be more aggressive in challenging mergers and acquisitions between large tech companies that would enhance market power for the resulting entity. The current commission believes attacking such trade practices helps better fulfill the FTC’s mission to encourage competition and protect consumer interests.

FTC Chair Background

FTC Chair Lina Khan‘s views on anti-trust have been clear since she published the article “Amazon’s Antitrust Paradox” in Yale’s Law Journal. This groundbreaking publication argued that the current state of the law on antitrust focusing on consumer welfare, often measured by price, is flawed. Khan claims the platform-based business models of big tech may have lasting consequences for consumer choice and innovation, as exemplified by Amazon. The e-commerce giant–one that sells privately labeled products and competes against smaller players selling similar products on a platform and infrastructure it owns–supposedly has an unfair advantage. As proposed reform, Khan suggested the government should increase focus on market structures and adopt a broader definition of competition that includes factors beyond price and consumer welfare.

Effects of the Deal

This acquisition deal has major implications for the tech market according to Jefferies Senior Analyst Brent Thrill. Companies are looking at this transaction among others. Should this deal close and Microsoft and Activision Blizzard essentially get a win, it may open the floodgates for other M&A deals. This may lead to a sector-wide cleansing through consolidation. This may result in increased scale and innovation, particularly in industries with numerous smaller players and startups such as AI, cybersecurity, or software.

What’s Next?

Although the Tuesday ruling was a huge win for Activision Blizzard and Microsoft, with Activision Blizzard’s stock jumping nearly 10% on Tuesday and currently about 6% under Microsoft’s $95-a-share offer, the battle with the FTC is not over. Once a full appeal is filed to the Ninth Circuit Court, the court has the authority to extend the TRO; however, there is limited time for such an extension as the existing order blocking the deal expires tomorrow. It is still unclear whether the appeals court will rule before the July 18 deadline for the deal. Furthermore, Microsoft is still yet to arrive at a deal with the British CMA regulators and will continue to negotiate, possibly editing the details of the deal to divest assets or include other solutions to satisfy the regulator.